By Terra.do, featuring insights from Katherine Markova.

As we move toward 2025, the shift from voluntary to mandatory climate disclosure is no longer theoretical. It’s real, it’s here and it’s changing everything.

In this special Terra.do event, Katherine Markova, a sustainability and climate risk expert with two decades of experience in corporate reporting shared a grounded, insider view of what’s driving this transformation, what companies can expect, and how professionals across finance, sustainability, legal, procurement, and communications must now collaborate to meet rising expectations.

From Voluntary to Required: The Global Reporting Tipping Point

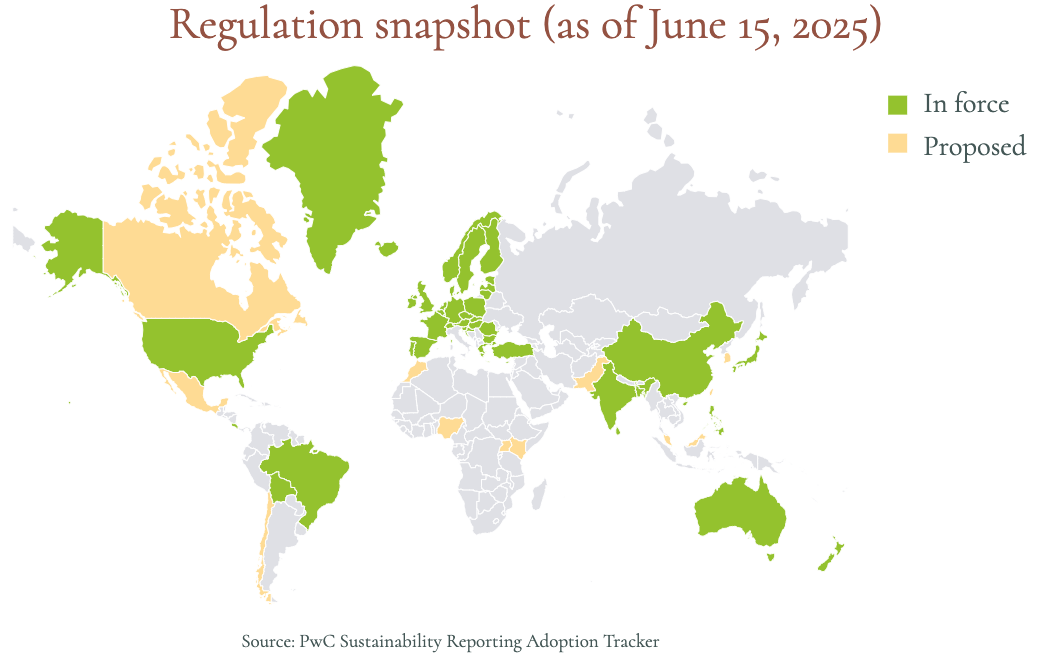

Until recently, nearly all corporate climate disclosures were voluntary. But that era is ending. With roughly half of global GDP now falling under mandatory climate disclosure laws, a new reporting era is unfolding. Katherine shared that frameworks such as the IFRS Sustainability Disclosure Standards (SDS), EU’s CSRD, California’s SB 253/261, and emerging policies in Canada, Australia, Japan, and the UK are leading the charge.

Each jurisdiction is approaching this transformation in stages, some already enforcing disclosures for large entities, others beginning phased implementation or actively shaping legislation. These changes reflect a clear message: voluntary compliance is giving way to legal obligation. Companies aren’t preparing, many are already reporting.

This shift not only raises the stakes for internal systems and governance but also repositions climate disclosure from a brand-enhancing tool to a regulatory necessity. It's no longer a matter of if companies will disclose — but how well and how fast they can do so.

Why Companies Report: The Real-World Drivers

So what’s pushing this shift beyond regulatory mandates? Katherine outlined six key forces:

Investor pressure, led by institutional giants like BlackRock and Vanguard, which demand emissions and risk data from portfolio companies.

Financial product requirements, especially for ESG-aligned funds that must justify inclusion criteria based on verified climate performance.

Business customer demands, where companies cascade data requests to suppliers and sub-suppliers, reinforcing transparency throughout the value chain.

NGO watchdogs, holding companies accountable for backsliding or misrepresenting climate commitments.

Litigation risks, including lawsuits challenging misleading claims around net-zero or carbon neutrality.

Societal expectations, driven by consumers, employees, and civil society, reinforcing transparency as a key part of license to operate.

These external drivers are rapidly becoming internal business priorities. Whether due to investor scrutiny or contractual requirements, companies are recognizing that proactive climate reporting builds competitive advantage and failing to report may pose financial, legal, and reputational risks.

Standards vs. Regulations: Knowing the Difference

Katherine made a critical distinction: Standards define how to report, regulations define why, when, and under what authority you must.

Standards (e.g., GHG Protocol, TCFD, ISSB, ESRS) guide methodology, scope, and format.

Regulations (e.g., California SB 253/261, EU CSRD) create the legal mandate and specify which standards apply.

This hierarchy matters. Companies must track not just what data to collect but which jurisdictions require it, how it's audited, and what penalties exist for non-compliance.

The distinction also reveals how power is shared: standard setters provide clarity and comparability; regulators drive accountability. Professionals need fluency in both to ensure their disclosures are not only complete but credible.

Consolidated Standards, Divergent Regulations

Over the years, reporting frameworks have consolidated into a handful of dominant standards. Yet each country implements these differently:

A U.S. company may follow California’s SB 253/261.

Its UK subsidiary must comply with UK-adapted IFRS standards.

Its French operations fall under ESRS.

Its Australian arm navigates another version of IFRS.

This fragmented landscape requires strategic decisions about centralized vs. decentralized reporting structures, internal governance, and data systems. Even minor national variations can carry major operational implications.

Harmonization at the global level may be advancing, but for now, multinational firms must prepare for regulatory patchwork. Compliance strategies that embrace agility, localization, and internal alignment are essential.

Climate Reporting Takes a Village

As climate disclosures become investor-grade, they're shifting from the realm of sustainability to the full enterprise. Katherine outlined a new collaborative norm:

Finance teams translate emissions and climate risk into financial terms.

Sustainability teams manage data gathering and scenario planning.

Legal determines jurisdictional applicability and risk exposure.

Procurement engages suppliers to surface and improve Scope 3 emissions data.

Communications and IR ensure accuracy, avoid greenwashing, and respond to stakeholder inquiries.

Boards and executives must be trained and able to understand, sign off on, and govern climate risks and disclosures.

The emergence of the ESG controller role symbolizes this shift: professionals with both accounting and climate fluency bridging once-siloed domains.

Katherine emphasized that internal buy-in is often a bottleneck. Demonstrating the strategic value of disclosures — not just their compliance burden — is key to unlocking cross-functional collaboration and executive support.

The Data Challenge: Fragmented, Non-Financial, and Complex

Unlike traditional financial reporting, climate data is scattered, unstructured, and often non-financial. Katherine cited examples such as:

HR systems tracking employee commuting habits.

Procurement databases detailing material inputs and emissions from suppliers.

Facilities data capturing energy use and water consumption.

Vendor platforms aggregating external data and estimates.

Bringing this data together into a consistent, auditable format requires digital tagging (e.g., XBRL, UML), purpose-built software platforms, and rigorous internal controls. Spreadsheets won't cut it in a world demanding real-time, machine-readable, verified data.

Data readiness is becoming an indicator of organizational maturity. The firms best prepared for audit and assurance are already investing in data governance frameworks and digital infrastructure that integrate climate data with financial systems.

The Paradigm Shift: From Single to Double Materiality

The EU’s double materiality approach marks a fundamental expansion in reporting scope:

Financial materiality: How climate change affects the company.

Impact materiality: How the company affects climate, environment, and society.

This pushes companies to map their broader impact—beyond financial risks—and integrate climate, biodiversity, water, and social equity data into governance and strategy. It’s a shift from reporting as compliance to reporting as responsibility.

For many organizations, this requires new metrics, stakeholder engagement methods, and internal processes to assess impacts not previously measured. The result is more holistic, inclusive decision-making — but also a steeper reporting learning curve.

Career Pathways: Training and the Talent Gap

As demand rises, so does the need for professionals who can bridge disciplines. Katherine described a gap in formal education for climate reporting:

Finance professionals must learn ESG frameworks and sustainability science.

Sustainability professionals must understand risk, controls, and assurance.

ESG controllers and related roles are becoming essential.

While some training exists (e.g., IFRS Foundation, TCFD resources), Katherine noted few programs prepare professionals for day-one delivery. That’s why Terra.do developed its Mastering Climate Reporting course, a four-week immersive designed to close this gap.

The evolving job market is opening new opportunities for hybrid careers. Whether in-house, advisory, or technology-focused, climate reporting is emerging as a high-demand, high-impact specialization.

Enforcing Truth: Assurance, Penalties, and Public Scrutiny

The era of greenwashing is meeting its match. Governments and stakeholders are doubling down on enforcement through:

- Mandatory assurance (phased in) by certified third parties.

- Penalties for inaccurate reporting, including fines and public censure.

- Litigation risk, as seen in cases targeting false neutrality claims.

- NGO and media watchdogs, surfacing inconsistencies and backtracking.

Katherine emphasized that first-year leniency is fading, and investor-grade accuracy is becoming a non-negotiable.

Scrutiny is increasing not only from regulators but also from peers, customers, and platforms. Third-party verification and internal review systems are now critical components of disclosure readiness.

Closing Thoughts: From Obligation to Opportunity

Climate reporting can feel like a burden. But it also presents a strategic inflection point. Companies that move beyond compliance and treat disclosures as tools for transparency, alignment, and accountability can unlock real value.

For professionals, this is the moment to skill up, step in, and shape how organizations understand and respond to climate risks and lead systemic change.

📘 Learn more about Mastering Climate Reporting course.

For more in-depth conversations and events, check out what's coming up next.